2020 has well and truly signalled the end of an era of easy asset accumulation for the asset management industry. As we have all been separated from the people we work with, we are naturally going to start thinking beyond our day-to-day role.

We believe that this is the wake-up moment where managers start to ask the question: do we have a point beyond just accumulating assets? If they can’t think what that is, then perhaps they deserve to be acquired by somebody who can.

To underline just how critical this is, a recent article in the Financial Times highlighted research claiming that ten ‘titans’ will each oversee more than $5 trillion, dominating an industry in which half of the current crop are expected to cease to exist by 2030. Furthermore, in Deloitte’s 2020 Investment Management Outlook, it found that since 2017, 37 asset management global CEOs have been replaced, illustrating the increasingly complex task of future-proofing their firms.

We believe that a strong culture and leadership are crucial components of an asset managers’ survival, so we have, (as a part of our 2020 Global 100 research) attempted to identify what culture is and provide a framework for assessing how well managers are codifying and communicating culture. What we look for in a strong culture is the importance of displaying leadership to investors and stakeholders in a year such as this.

Culture has become increasingly central to our conversations with marketing leaders. Recently, in the first episode of the Peregrine Podcast, Kelly Vives, Head of Marketing at Wells Fargo Asset Management, put her finger precisely on the challenges that the global pandemic has thrown up for companies' cultures. “At BMW, when they put their cars on the assembly line, one of the last steps is that they shake it vigorously for 20 seconds to see if any nuts and bolts unscrew – that’s what being a marketer in 2020 has been”. Kelly went on to say, “there are so many pieces that go into culture, and the hardest part as marketers is nailing that narrative and how do you actually bring that to life, how do you make it storytelling about the people as opposed to the buzz words that everyone expects from firms like ours.”

What is Culture?

Culture is hard to define. Like individual charisma or personal chemistry, we know that culture is important for brands, but it is very hard to pin down. For allocators and investment consultants like Willis Towers Watson and Mercer, culture is closely evaluated in the capital deployment process.

Performance can get a meeting with an investor, but a clearly articulated process and culture are important indicators of longer-term sustainability. Although culture is difficult to define, we can clearly see its effects, both in what companies say, and even more importantly, what they do. In looking at this issue ourselves, we have been influenced by Willis Towers Watson’s process for measuring asset managers’ cultures. For them, the most crucial elements to assess include employee and client value proposition, diversity, team stability, alignment with stakeholders, and leadership.

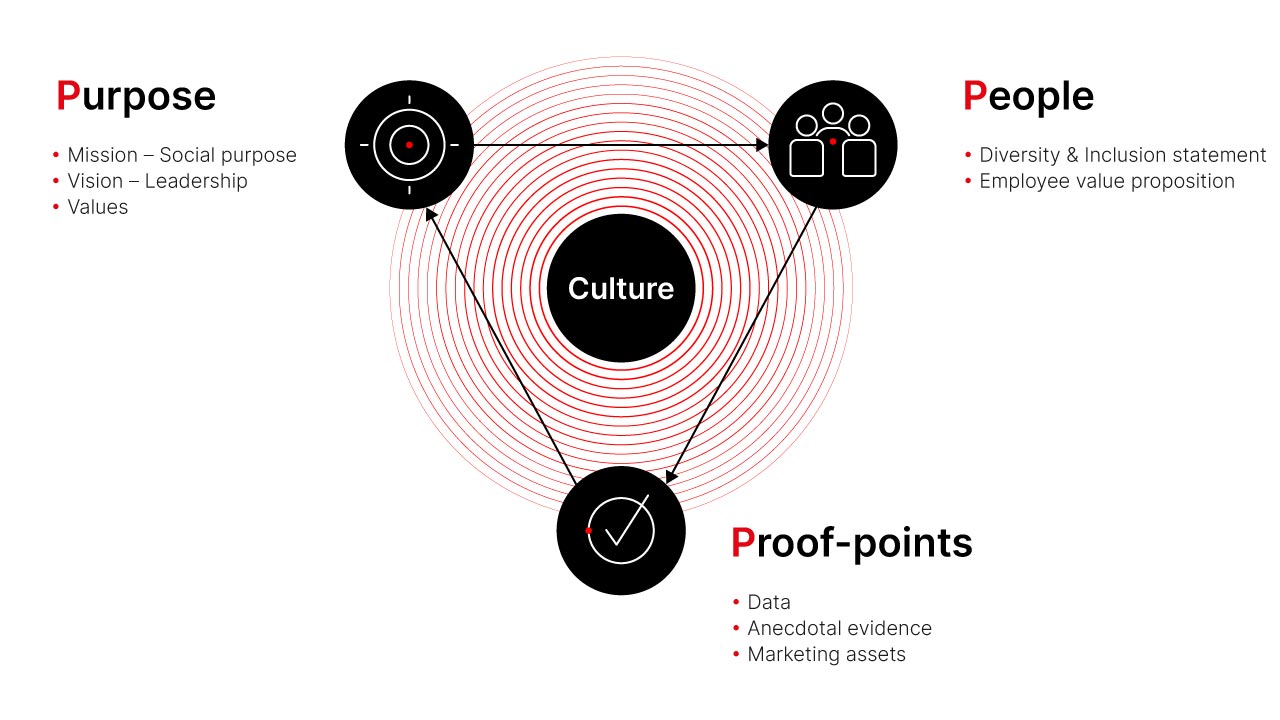

Peregrine has codified this as the 3Ps of culture framework: Purpose, People and Proof-points.

Purpose

Purpose is about why a business exists and why it deserves to exist in the future. For asset managers, there needs to be a clear sense of what value is created for clients, both in terms of partnership and performance. But there also needs to be a sense of what the vision is for the company and its employees going forward (i.e. Mission, Vision and Values), mapping onto the company’s purpose for society.

In terms of visible culture content pertaining to Purpose, 90% of the 100 largest asset managers* had publicly facing culture pages on their websites aimed at defining and promoting their workplace and culture. The fact that only one in ten firms assessed failed to outline their culture shows just how seriously the industry now takes the challenge of demonstrating their corporate cultures. However, when we assessed whether firms had undertaken the harder challenge of defining the mission, vision and values, 40% of managers* were unable to publicly communicate any clear mission, vision or values. This suggests that managers find it easier to talk about the talent and employee aspect of their culture and purpose than they do their societal objectives or motives.

People

Intelligently led companies create a vision and mission that spawns a shared ethos among its colleagues and partners. They also put in place platforms to allow their people to build something that exceeds the sum of the parts. This environment is now a critical assessment criterion for investment consultants. In fact, in many cases can be a deal-breaker where it is clear that a firm has a poor culture or is not able to articulate its employee value proposition.

When it comes to how asset managers communicate their edge around People, 95% of firms have a publicly facing diversity disclosure, with some firms having additional supporting content, such as videos (5%) or dedicated landing pages. Nonetheless, these were rare. Contrastingly, only 40% of the firms had a visible employee value proposition, nothing to articulate what was distinctive, special or beneficial about working with their firm.

This is surprising given the strategic importance of talent acquisition and retention, but the failure of so many managers to talk meaningfully about how they attract, retain and develop an engaged workforce represents an opportunity for many firms to materially improve their culture rating.

Proof-points

Prove it. Whether corporate culture is coming under scrutiny from LPs, investment consultants, financial advisors or potential talent, information needs to be publicly available and relatively easy to obtain. If it isn’t, an opportunity to convey the information in a positive way will be missed.

As well as making sure you are able to evidence any claims you make about your culture, your people or your purpose, you must also put the requisite thought into which medium will best carry the information you want to share. When it comes to the assets you use to demonstrate your cultural edge, it’s worth thinking about a varied mix of formats and media. Video content may be better able to engage a potential employee who wants to get a sense of ‘cultural fit’ whereas a more granular diversity report may be suited to a webpage.

Displaying Leadership During COVID-19

The pandemic has tested managers’ cultures in a way never seen before, and underlined the importance of leadership for both internal and external stakeholders. With clear information in such short supply, for investors, allocators and wealth management professionals, the value of having partners who communicated with their stakeholders quickly, clearly and directly was unmistakably important.

This also added a real question mark over which CEOs would come out well from the crisis and which would miss their opportunity to demonstrate leadership to their teams, colleagues, external stakeholders and wider communities. With stakeholders wanting to know how businesses were preparing to be part of the solution, this was a somewhat binary situation for asset management CEOs. Either they would come out showing direction, visibility and tangible action or they would have gone missing when they were needed most. Underpinning this, is culture, and it is essential to the survival of your asset management firm.

For more insights on culture, please see our Global 100 report. or read about how Star Power Operates as Brand Leverage