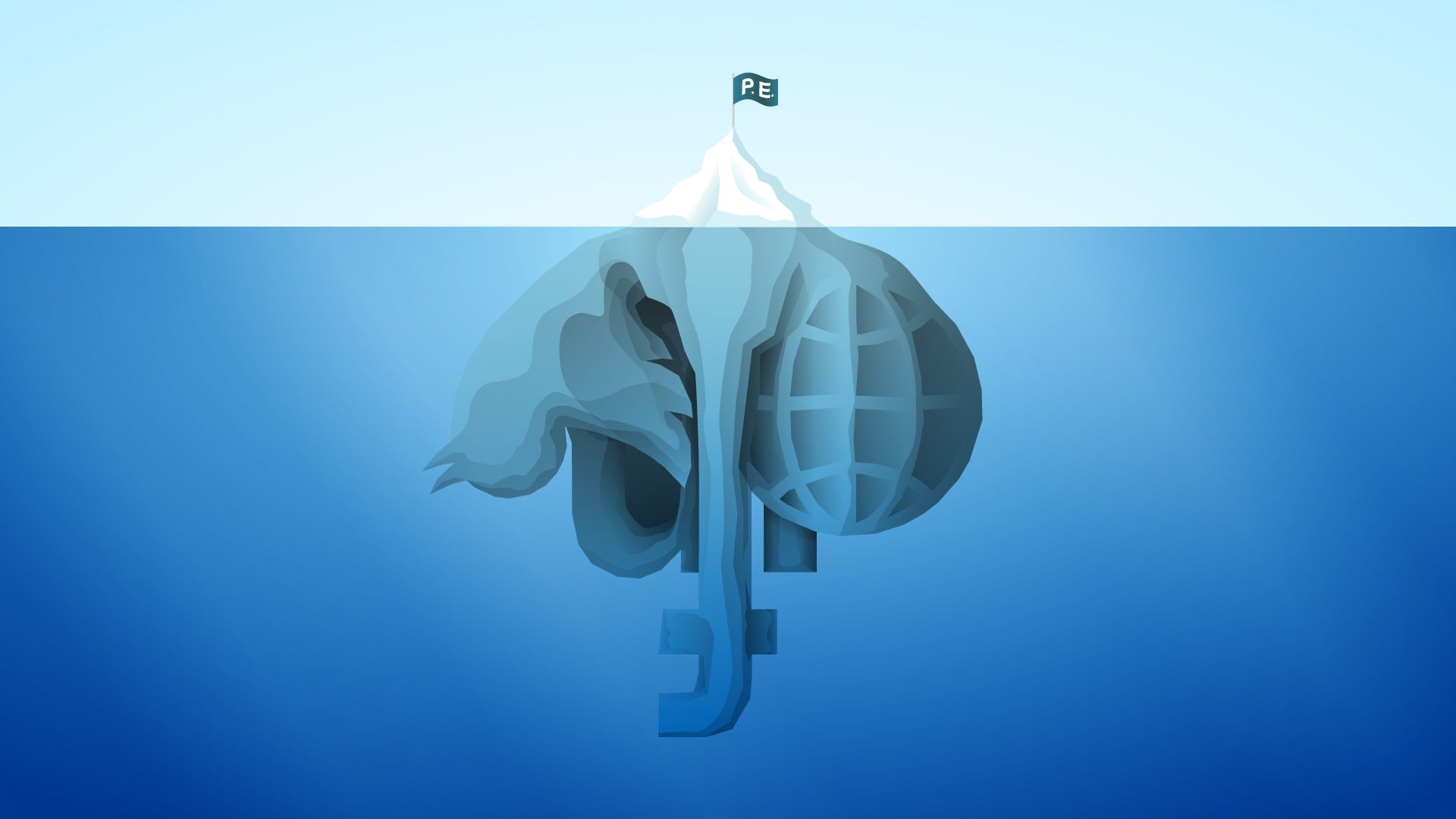

Larger firms are usually ahead of the curve when it comes utilising the latest technology to attract investors. However, our research found that the size of a private equity firm or its heritage is irrelevant when it comes to effective digital marketing.

We looked at the top 50 UK private equity firms and found that there was no correlation between a firm’s AUM and the effectiveness of its digital marketing: the top five firms managed between £470 million and £5.5 billion. Smaller private equity firms were more than capable of competing with their larger counterparts.

Our research found that the size of a private equity firm or its heritage is irrelevant when it comes to effective digital marketing.

Palatine (ranked second) manages around £470m whereas Permira (ranked first) manages £5.5bn. Likewise, mid-sized firms like NorthEdge Capital (71% and 3rd overall) and Endless (67% and 4th overall) overcame any disadvantage associated with their relatively small size through visually appealing websites.

Our data shows that there is a closer correlation between the age of the firm and a failure to embrace digital channels effectively, as shown by the bottom-five ranked firms. Charterhouse Capital Partners (est. 1982), Hermes GPE (est. 1992), and Capital Trust Group (est. 1985) have all established themselves as key players in the private equity industry. However, none of these firms have a social media presence.

The failure of top PE firms to capitalise on digital marketing means that this is one of the few areas where smaller players have the opportunity to take the initiative and lead the way. This is a great way for smaller firms to attract talent, promote CSR initiatives, source deals, build strong brands, distribute content, and attract investors without a huge marketing budget.