By now pretty much everyone knows about Ray Dalio. A Google search or a glance at YouTube uncovers plenty of items from the world’s leading hedge fund manager.

Book excerpts, narrated videos about the “economic machine”, TED Talks, and interview clips from CNBC are all part of his prolific output. In recent years, Dalio has also taken to posting regular thought pieces on LinkedIn and even tweeting.

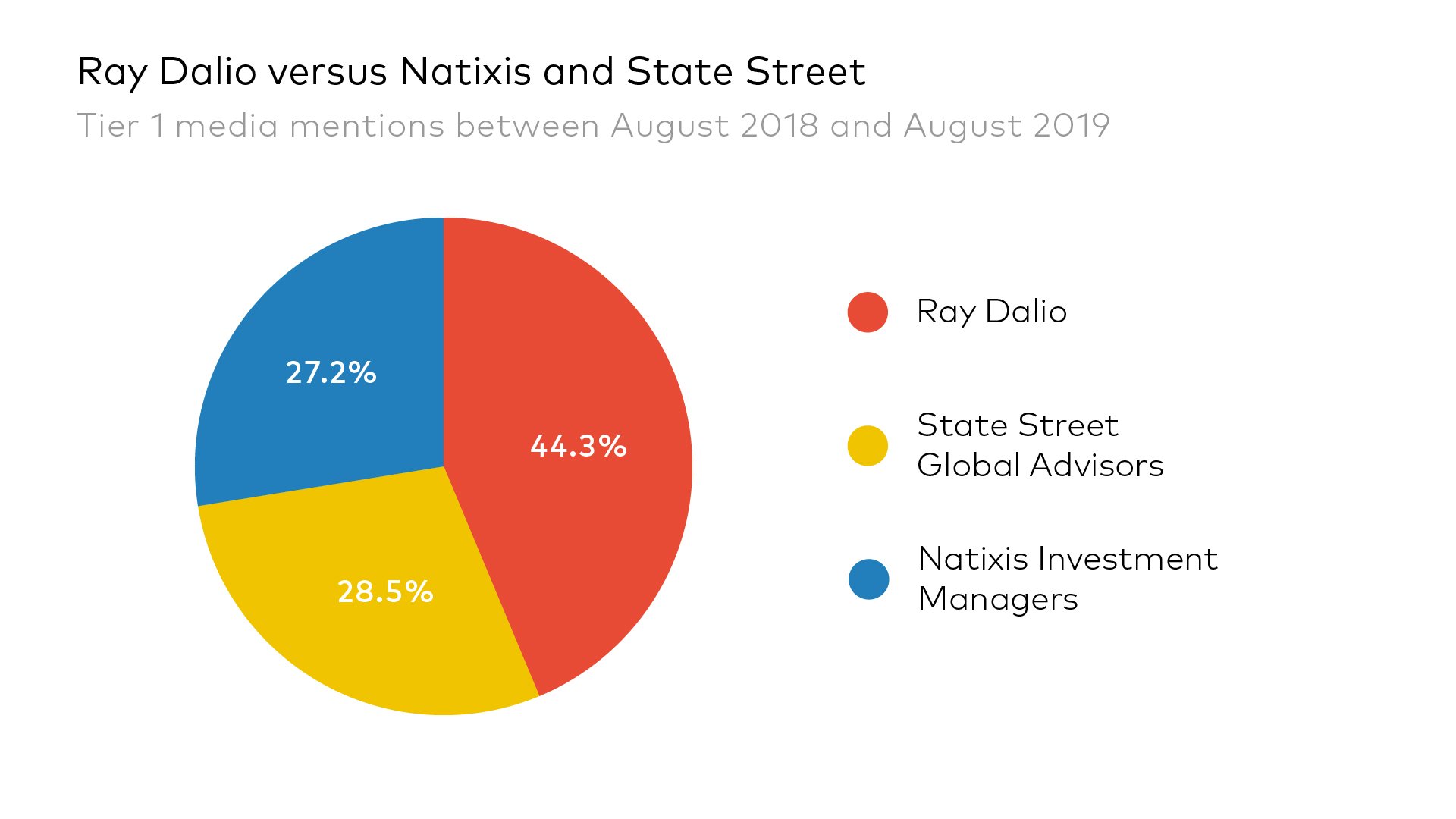

Dalio’s exceptional quotability creates real cut through. Indeed, he has even more Tier 1 media mentions than either State Street Global Advisors or Natixis Investment Managers. (Exhibit 1)

Through creating and curating his own media presence across an increasing number of channels, the Bridgewater Associates founder has become a brand in his own right. So, what underlies brand Dalio’s communications success and indeed ubiquity?

Several things, it turns out. But before examining these, it is useful to bear in mind Dalio’s own maxim put forward on his LinkedIn profile. “Ray believes that reality works like a machine and that principles for dealing with reality are required to be successful.”

At Peregrine we believe this applies to communications. In fact, the impetus for this blog comes from Peregrine’s data driven and functionalist research into understanding best practice in integrated marketing communications. This has prompted us to investigate Dalio’s modus operandi as a way of gaining insights into Bridgewater’s development and long-term success.

From this we have observed five things that drive how Dalio communicates. We believe this throws up lessons for other fund managers to consider how best practice in marketing communications can help them improve business outcomes both now and in the future.

1. Consulting Mindset

Although Dalio began investing as teenager, his early work involved consulting on investment solutions. As Dalio himself notes, being a consultant involves constantly innovating, always soul-searching and continually asking: ‘Have we got this right?’

It also requires empathy and a ferociously extrovert interest in others – the client (certainly) but also anyone who can help deliver a result. But more than being able to assume the client’s perspective, the successful consultant must be able to communicate alternative courses of action, relate likely outcomes, gauge different options and offer an optimum solution.

It was while doing consulting work (to avoid the drudgery of going into a Wall Street firm) that Dalio realised clients wanted ongoing advice about markets. To lighten the time demands of responding to each client on an individual basis, Dalio launched a regular controlled circulation newsletter. Four decades on, BridgeWater’s ‘Daily Observations’ is a must-read analysis for investors and policy makers around the world.

2. Transparency

From the early newsletter onwards Bridgewater offered transparency and knowledge transfer. Quite a contrast with the super secretive approach of hedge funds and boutique investment specialists, particularly in the decades before the Global Financial Crisis.

Transparency shows how Dalio understands the accretive value to Bridgewater of creating a more open and educational service model. It helped enormously that the founder had a V12 intellect powering this. With Daily Observations, investors receive brief topical items on that day's market developments and major white paper research projects running 20 pages or more.

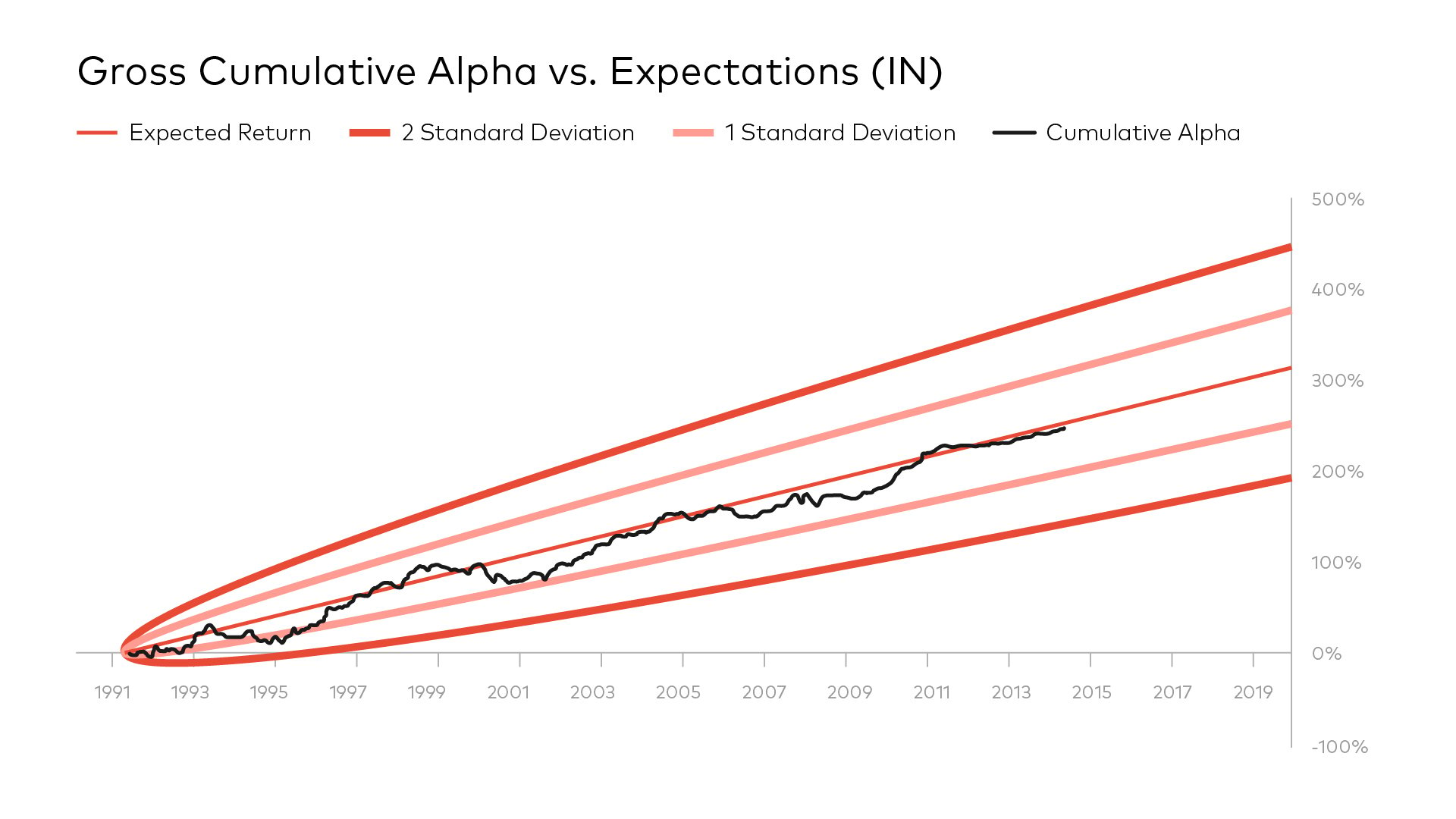

Transparency is furthered by monthly performance briefings with one or more of the three co-CIOs (Dalio, Bob Prince and Greg Jenson) and other senior team analysts. The calls not only discuss performance drivers but also positions actual outcomes vs forecast returns (and in the context of standard deviations) since inception.

3. Modelling

Bob Prince calls Dalio a “big-picture thinker”. Nowhere is this more apparent than in the models he creates.

Models are a powerful communications tool that describe casual relationships and logical, provable outcomes. They are especially useful for explaining a forecast or economic relationship in a one-to-one presentation or online.

A simple model is the one Dalio invented to price Chicken McNuggets. In the early 1980s, McDonalds wanted to develop the product – now its biggest seller – but faced considerable volatility in the chicken market. This made it impossible for chicken suppliers to offer stable prices and for McDonalds to set and keep a price in its customers’ price range.

Dalio modelled the chicken as the sum of its parts: a chick, plus the corn and soymeal required to grow the baby bird into a grown chicken. By buying or selling corn and soybean futures, the chicken supplier could hedge costs and provide a fixed cost to McDonald's for the price of chicken McNuggets.

The power of a model, Dalio has explained, comes from helping to communicate the connection between “what is happening today” and how it “fits into the Bridgewater framework for making decisions”.

Establishing this type of connection is what great communication is all about. It leads to clients committing more capital over time for longer.

4. Graphics and Videos

Seeing simple, powerful graphics don’t come much more compelling than Dalio’s presentation of “How The Economic Machine Works”. This illustrated 30-minute video is a powerful indication of how graphics bring a story narrative to life.

Youtube features numerous videos from Dalio and other Bridgewater colleagues addressing investing, decision making and more. A 2017 TED Talk on How to build a company where the best ideas win has Dalio discussing how radical transparency and algorithmic decision making will change your life.

Even rudimentary graphics (Exhibit 2) tell a powerful story with attention grabbing comparisons. The middle pink line lays out the ‘expected return’ from the strategy with calculations of standard deviations and cumulative alpha. The same performance chart framework is used for Bridgewater’s two main funds “All Weather” and “Pure Alpha”.

The message is simple in construct, but evocative about returns actual and forecast. The messaging is given added power by its explicit referencing of a consistent future return stream.

5. Trial and error methodology

Trial, track, acknowledge errors, analyse and learn might sum up Bridgewater’s approach to generating the consistent returns just discussed. Sure, clients are most interested in how this applies to investment problem solving.

But trial, error and acknowledgement are also very useful tools to apply to client communications and media engagement. Social media and networks such as LinkedIn provide lots of opportunity to “trial and track” what works and what doesn’t.

A constant refrain from Dalio is how he has made lots of painful mistakes. Acknowledging that and building principles on the back of it – in markets and in communications – that can be further tested can improve decision making and outcomes over time.

Embedding algos in decision making has driven investment performance. Applying this to communications, websites and user experience can also propel powerful results and give an investment business a sustainable edge over time.

Dalio’s consistent approach to investing and managing communications offers valuable tips to any fund manager. Above all, it proves that investment and communications excellence really do go hand-in-hand.