At the top of this year’s rankings, BNP Paribas AM, Robeco, and Schroders proved their position as frontrunners in communicating about ESG through traditional earned media.

However, we also wanted to examine how firms use social media assets to communicate their ESG proposition. To do this, we analyzed the LinkedIn, Twitter, YouTube, and Instagram accounts of the three managers to gauge how these firms are building Brand Awareness through social media channels.

With the need for an authentic narrative being so crucial, investors expect to see consistent ESG content and messaging reflected across all communications – including, most notably, on social media channels. By its nature, ESG content performs well on social media. It often allows for more creative visuals, is people and purpose focused, and is uniformly more emotive than other financial communications. In sum, ESG content appeals to, and therefore reaches, a much wider audience.

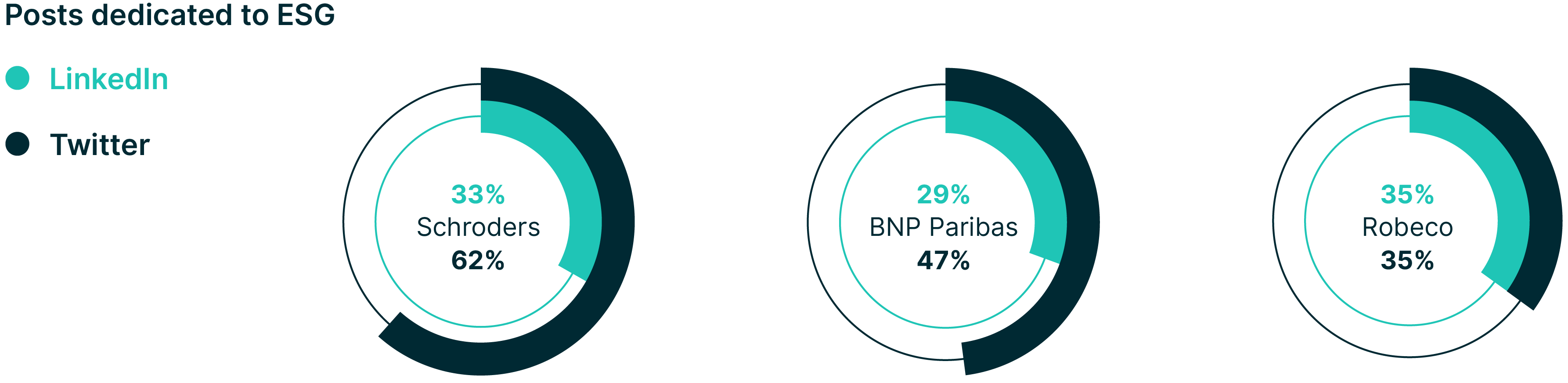

LinkedIn is the most widely used platform in the asset management industry, and so it was no surprise that all three managers utilized this channel to push ESG related content. It was a surprise, however, that all three managers dedicated about one-third of their posts to ESG – Robeco (35%), Schroders (33%) and BNP Paribas AM (29%). When it came to Twitter there was greater variance: over half (62%) of Schroders’ posts were ESG related compared with 47% of BNP Paribas AM’s and, identical to LinkedIn, 35% of Robeco’s.

Robeco, which posts almost three times more frequently on both LinkedIn and Twitter than either Schroders or BNP Paribas AM, fell victim to content overload – posting more than once a day – which diluted the impact of its ESG messaging. In terms of best practice, our research shows that five pieces of content a week is optimal in terms of securing engagement. In short, the focus should be on quality over quantity.

A clear narrative emerges from Schroders’ and BNP Paribas AM’s channels. Schroders' ‘Purpose Beyond Profit' campaign was inescapable over the last year, due to their consistent, multi-channel and long term approach to digital advertising. BNP Paribas AM’s ‘Age of Transformation’ series was also consistently shared. Schroders went a step further, however, building upon their ‘Purpose Beyond Profit’ theme with the ‘#MyStory’ video series which spotlights people and companies around the world having a significant impact. Whether that be on plastic recycling in Japan or Darling Ingredients which turns animal fats into biofuels. As a result, Schroders jumped 15 places in this year's ranking, with very strong Brand Awareness and Brand Momentum scores directly related to ESG. Their ESG-Brand Momentum score alone increased from 2 to 10 this year, a clear example of the impact a consistently messaged and well thought out integrated campaign can have.

Schroders' 'Purpose Beyond Profit' campaign was inescapable over the last year, due to their consistent, multi-channel and long term approach to digital advertising.

Too often we have seen managers put out multiple campaigns a year, all conveying different messages. This may lead to temporary spikes in Brand Awareness, but it takes a coherent message and a sustained approach (over several years) to content and advertising to affect real change over the long run.

A channel seldom discussed in asset management is YouTube. There has been a clear ESG push on YouTube by both Robeco and Schroders. Over half (62%) of Robeco’s recent videos have tackled ESG topics, with interviews on sustainable investment and a video series from the #TimeToAct event. Schroders similarly dedicated half (50%) of their YouTube channel to ESG – unsurprisingly as their ‘Purpose Beyond Profit’ campaign is largely in video format. BNP Paribas AM’s ‘Age of Transformation’ video series is not on their YouTube channel, an obvious missed opportunity to maximize the reach of the campaign.

The notion that ESG content excels on social media is especially true for Instagram where its predominantly visual format works well. Nevertheless, Instagram is a platform where asset managers are struggling to find their feet. Notably, Robeco and Schroders, have yet to grasp the value of Instagram. Robeco, which is especially communicative on its other channels, posts infrequently (1–2 times a month) on Instagram, often with content that does not match the format. Schroders, whose ‘My Story’ video series is undeniably suitable for Instagram, doesn’t even use the platform.

In contrast, private banks such as Lombard Odier and Union Bancaire Privée show what can be achieved by dedicating an Instagram account to impact investing and ESG. For instance, Lombard Odier, via its Instagram, has built up significant Brand Awareness around the key theme of a circular economy (a systemic approach to economic development designed to benefit businesses, society, and the environment). With over 14,000 followers and more than 25,000 engagements in the first four months of 2022 alone, Lombard Odier has established itself as a thought leader and industry pioneer. It is also significant that BNP Paribas uses Instagram with nearly one-half (43%) of recent content ESG-related, although the account is a general corporate one, and not specific to the asset management business.

It is evident that even those who score highly in our ESG rankings this year are not using social media to its full potential. Peregrine believes that a fully integrated, multi-channel approach, joining digital marketing and traditional communications offers the most effective means to build a firm’s brand through ESG.

Read our full ESG Report.