A new special report in The Economist aptly entitled The Money Doctors provides considerable food for thought about trends in asset management and the future of investing. It has arrived at the same time as Peregrine’s second annual survey of the Global 100 - How the world’s largest asset managers perform across their integrated marketing communications (IMC).

Perhaps the most arresting observation in The Economist report is that mid-sized asset managers – defined as those outside of the top 25 with less than $1tln in AUM – should strip back to their core offering, cut fees, and offer fewer products, and refocus on ones where the manager has a chance to be distinctive. The rub, however, is that such a bold course is unlikely to be embraced since existing investors tend to stay put, letting mediocre firms benefit from the iron law of inertia.

Yet even though many mid- and boutique-sized managers will get away with it, the future is more likely to be shaped by the bold, those who embrace a distinctive strategy. Indeed, Peregrine’s G100 report identifies a host of such asset managers – Robeco, Baillie Gifford and BMO Global Asset Management – who don’t rank in the top 20 by AUM, but beat bigger peers hands down because they use IMC to effectively highlight a differentiated investment proposition.

Apple: the importance of brand story

Think of Steve Jobs, who recast Apple when he re-joined in 1996, cutting product lines (remember Ulysses?) to focus on broader and simpler ones where it offered something distinct. Crucially, Jobs recognised what still eludes too many leaders in asset management: the critical importance of being differentiated and having a brand story to communicate it.

With investment managers, performance may get you a meeting, but the enduring winners in the sophisticated upper echelons of the business are the big brands. Such brands, including Fidelity, PIMCO and Blackrock among others, succeed precisely because they have well-articulated, differentiated selling points, a compelling story and, in sum, a more interesting brand.

Arriving at such a position doesn’t happen by chance. Certainly, serendipity and good fortune can play a part. But the key thing to having a more compelling brand is understanding the integrated marketing building blocks of developing one. In this regard, we believe IMC offers a logical and progressive way to think about it. This is why Peregrine takes an active role in researching best practice in IMC and tabulates data and analysis on the best performers in our Global 100.

Asset managers hesitate to take bold steps

A key finding of the survey is that a worrying number of firms, whose brand awareness is stagnant or declining, are hesitating to take the bold steps needed to revitalise their corporate story and strategic direction. The Global 100 found that nearly 6-in-10 (58%) of the leading asset managers saw no increase or a decline in their organic Google search volumes, despite firms seeing on average a 9% increase in inbound Google search interest for their brand. Moreover, at a time when LinkedIn is the corporate networking tool du jour, over one-third (36%) of firms scored less well in 2020 on social media performance compared with the prior year.

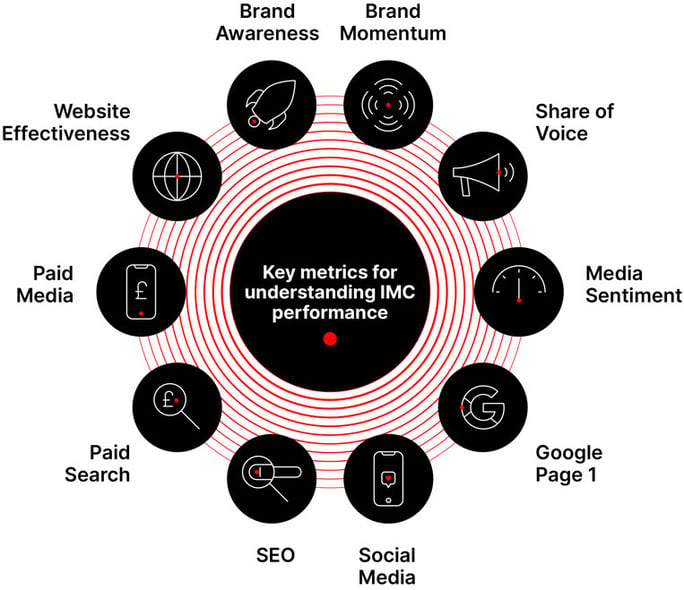

Peregrine’s analysis of IMC performance scores and ranks each firm against industry peers on 10 key metrics.

The first aim of the survey and of our diagnostic work with clients, is to show firms a data map of where they are currently and how they benchmark against peers. Our other aim is to provide a window into the asset management industry’s trends as well as insight into the most useful case studies and emerging best practices. This helps us devise client solutions with more business impact.

Data shows IMC works

We have a bevy of case studies that show the cascading impact that thoughtfully conceived, well executed IMC generates over time. Moreover, the G100 report itself provides persuasive evidence of the case for IMC: 19 of 20 firms who outperformed in the areas we measured grew AUM over 2020.

Returning to the Money Doctors report, The Economist observes in a section entitled Passive attack that Fidelity’s scale in both managing assets and in selling funds confers on it some unique advantages. These span retail distribution, brand leverage, cost mitigation and investment product creation, among others.

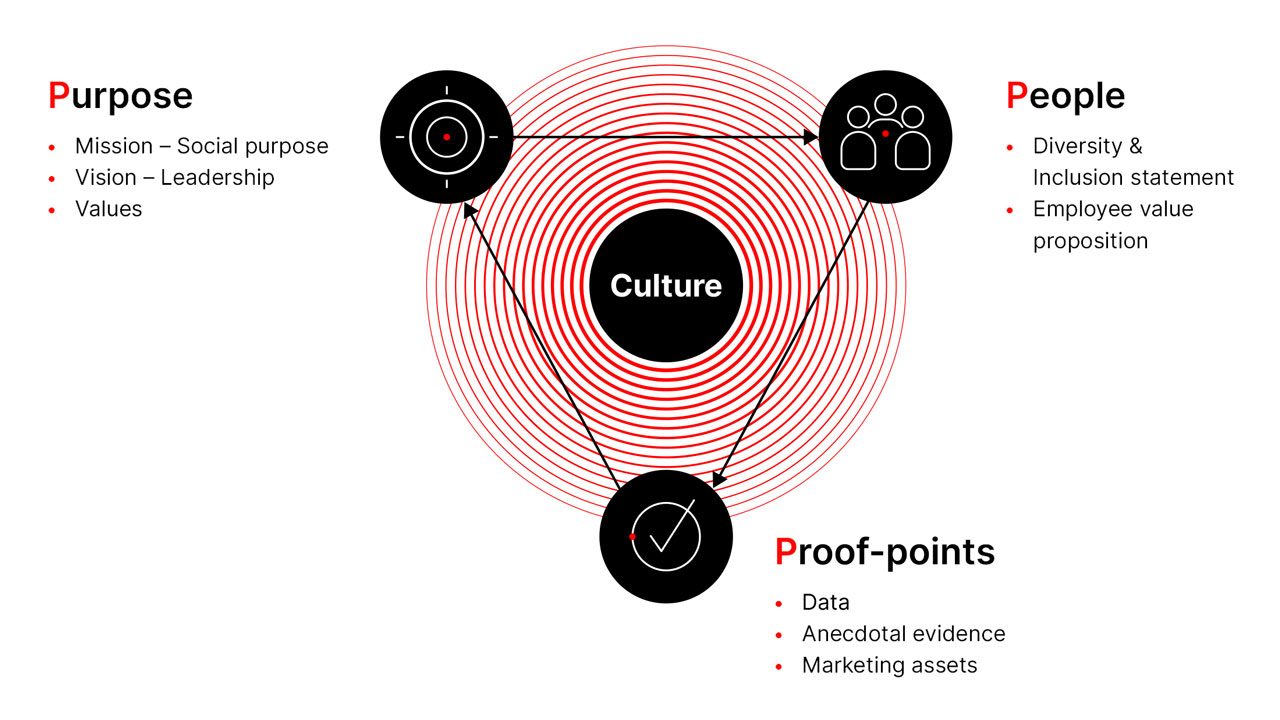

But Fidelity under Chairman and CEO Abigail Johnson takes this further, exemplifying what Peregrine has codified as the 3Ps of culture framework.

While Fidelity ranked No 1 in Peregrine’s Global 100 for its IMC performance, scoring a commendable 85 (100), Johnson stood out for her assured, proactive response to the Covid-19 pandemic. This included the announcement on her personal LinkedIn blog – When others step back, Fidelity steps up – that the firm would make 2,000 new hires to boost customer service. Highlighting that Fidelity had already increased customer interactions by 30% year on year, Johnson was able to communicate a clear narrative about how the firm would be continuing to create jobs for communities and continue to improve a best-in-class customer service infrastructure for clients.

Modest steps can have big impact

Of course, not every mid-sized and boutique asset manager could take such big steps. But in many cases, including one hedge fund industry leader, the firm did put considerably more muscle into communicating with clients and improving investor experience through a new series of enhanced portfolio manager webinars and more knowledge sharing. The firm has been rewarded with a revitalised brand that has attracted positive media coverage, several highly regarded recruits bringing new investor solutions and rising investor allocations.

One other aspect of The Economist report is of particular interest to active and boutique investment managers. It concerns the reasons for the continued rise in private assets. In addition to factors such as investors’ disenchantment with public markets (volatility, a torrent of regulation) and changes in banking (the well documented retreat from lending and liquidity provision), there is the inspirational success of so many of the sector’s pioneers from Stephen Schwarzmann to Ray Dalio and George Soros.

To us, this seems self-evident. What gives this more resonance is the story telling power that these pioneers and their current day successors have, especially in this era of massive disruption.

Using IMC offers considerable scope for any manager to differentiate their offering and highlight how the specific attributes of their firm’s culture drives the investment process. It’s clear that gains through IMC accrue over time – here Bridgewater provides a salient case in point.

In sum, IMC can help investment managers create a narrative to draw in prospects and turn them into loyal clients over time. We believe this is compelling and actionable for boutique, active managers everywhere and we look forward to exploring how IMC can help grow your firm.